Picture Supply: https://www.pexels.com/photo/piggy-bank-with-coins-9660/

For individuals with variable income, managing finances can feel like a balancing act. Uncertain paychecks and irregular income streams require a unique approach to budgeting, saving, and, importantly, building credit. In this blog post, we’ll explore how apps, an innovative financial app, can be a game-changer for those dealing with variable income, offering a comprehensive solution to not only manage day-to-day expenses but also build a strong credit history.

Understanding the Challenges of Variable Income:

Variable income, common among freelancers, gig workers, and entrepreneurs, presents its own set of challenges. Traditional financial tools and systems are often designed with steady paychecks in mind, making it challenging for those with irregular income to navigate the financial landscape seamlessly. Irregular cash flows can lead to uncertainty in budgeting, saving, and meeting financial obligations.

Tailored Solutions for Variable Income:

Kikoff recognizes the diversity of income streams and provides tailored solutions to address the unique challenges faced by those with variable income. Let’s delve into how apps can assist in effectively managing finances and building credit, even when income is unpredictable.

Smart Budgeting for Irregular Incomes:

Budgeting features are particularly useful for those with variable incomes. The app allows users to set flexible budgets that adapt to changing income levels. By categorizing expenses and setting priorities, individuals can better manage their spending, ensuring that essential bills are covered even during leaner months.

Picture Supply: Pexels

Microsavings for Financial Stability:

Kikoff’s microsavings feature is a game-changer for individuals with variable income. It enables users to automatically set aside small amounts of money from each paycheck for specific savings goals. This ensures a consistent savings habit, regardless of fluctuations in income. Whether saving for emergencies, future expenses, or investment opportunities, microsavings make it easy and manageable.

Credit Building with Predictable Payments:

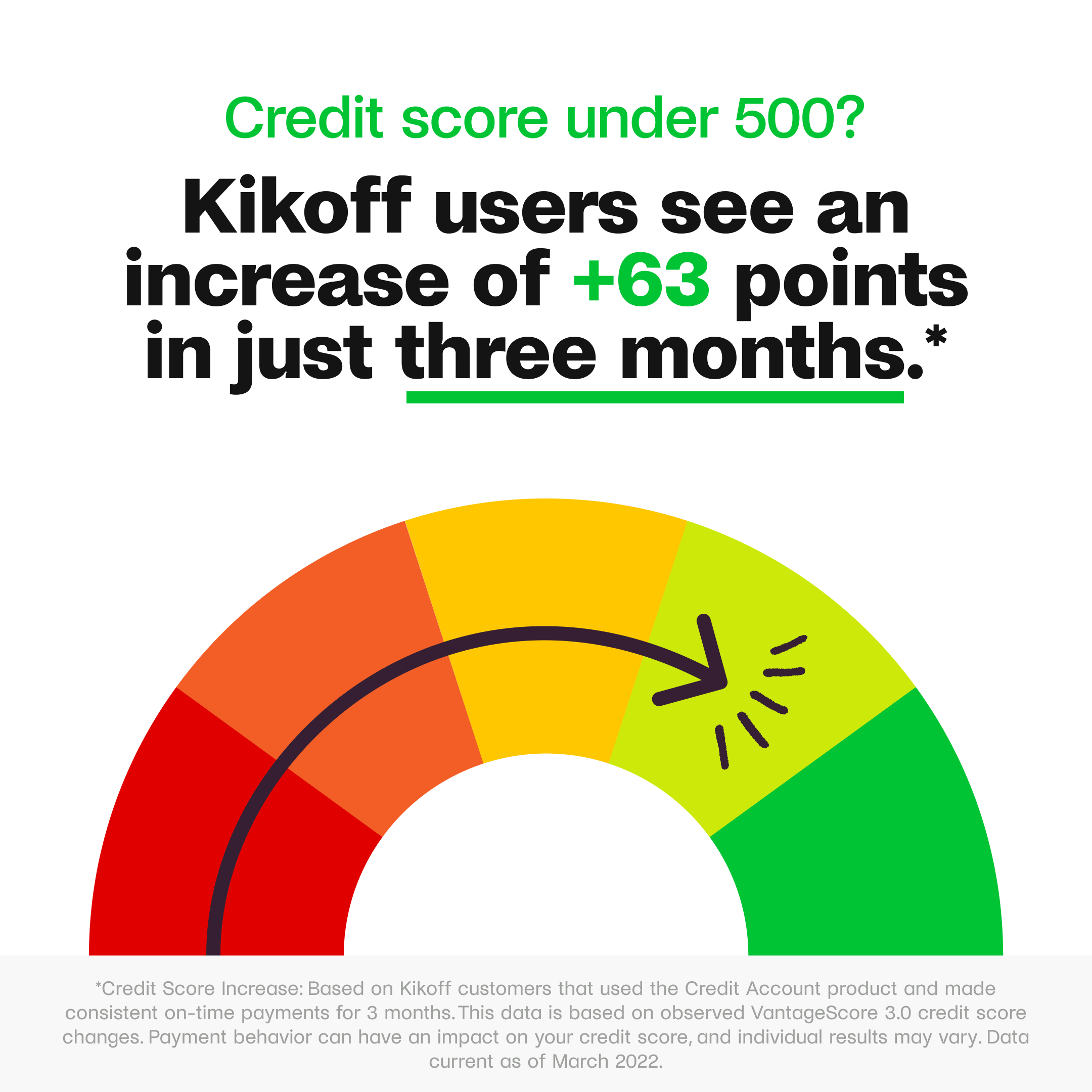

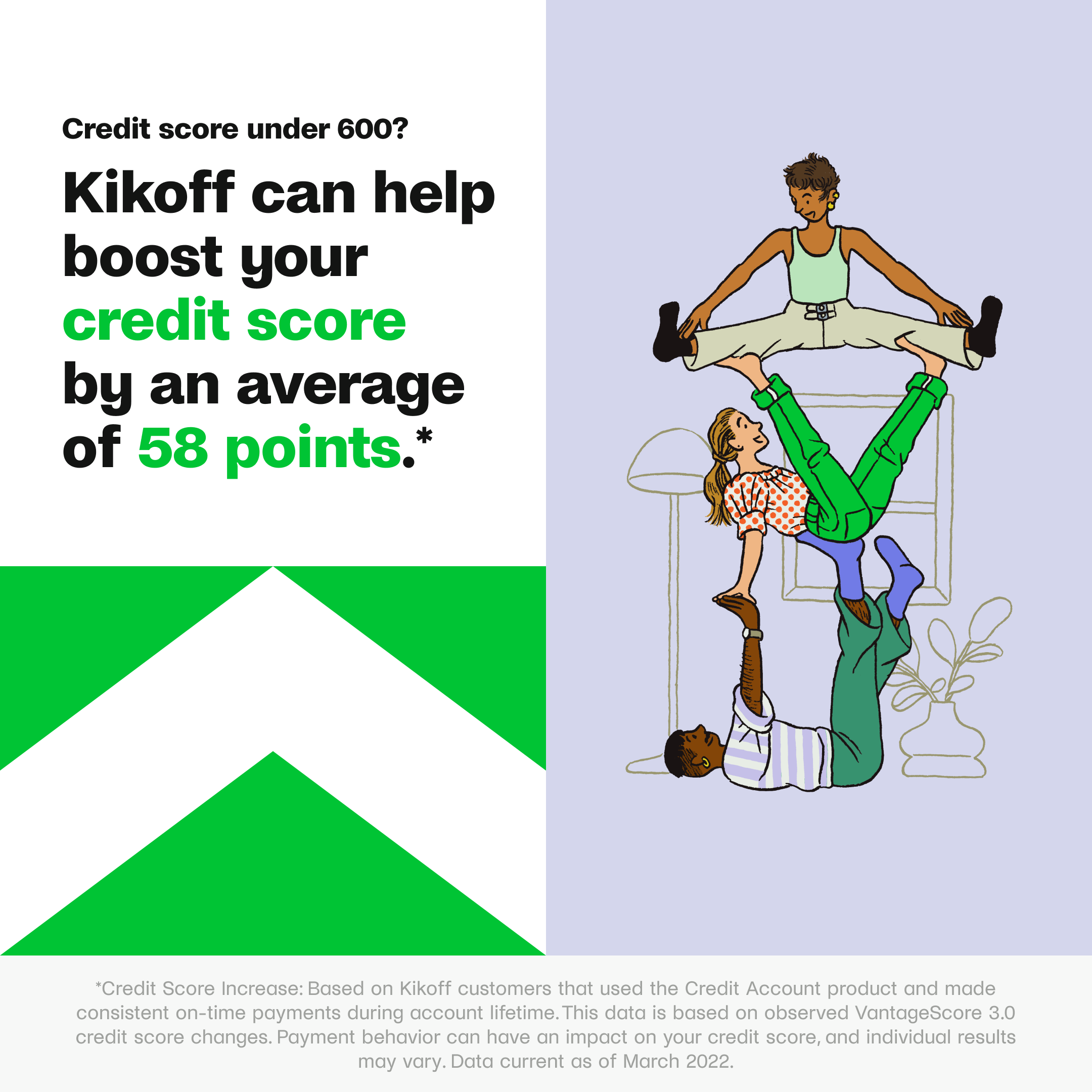

One of the challenges for those with variable income is the impact on credit scores. Credit-building features offer a solution by allowing users to make small, predictable payments. These payments contribute positively to credit history without creating financial strain. It’s an innovative approach that aligns with the irregular income patterns of freelancers and gig workers.

Flexible Credit Options:

Apps understands that traditional credit cards may not be suitable for individuals with irregular income. Therefore, the app provides flexible credit options that cater to varying financial circumstances. This flexibility empowers users to access credit when needed without being tied to rigid repayment schedules.

Financial Education for Empowerment:

Financial literacy is crucial for anyone, but it becomes even more vital for those managing variable incomes. Kikoff goes beyond being a financial tool; it’s also an educational resource. The app offers insights, tips, and educational content to help users make informed financial decisions, navigate credit responsibly, and plan for a secure financial future.

Picture Supply: Pexels

Real-Life Success Stories:

To truly understand the impact of apps on managing variable incomes and building credit, it’s insightful to explore real-life success stories. Users have reported improved credit scores, better financial management, and a sense of empowerment in the face of irregular income.

Tips for Optimizing Variable Income:

Utilize Predictive Budgeting: Leverage predictive budgeting tools to anticipate income fluctuations and adjust spending accordingly.

Set Realistic Savings Goals: Use microsavings to set achievable savings goals, considering the variability of income. This ensures consistent progress toward financial objectives.

Explore Credit-Building Options: Take advantage of credit-building features by making regular, manageable payments to strengthen your credit history.

Stay Informed: Regularly check educational resources to stay informed about best practices for managing variable income and building credit.

Empowering Financial Stability

Managing variable income and building credit may seem like a complex puzzle, but with the right resources, it becomes a streamlined and empowering experience. The app’s thoughtful features and flexibility cater to the unique needs of individuals with irregular income, providing not only financial stability but also a path to building a robust credit history. As more people embrace the gig economy and non-traditional work arrangements, tools like Kikoff play a pivotal role in ensuring financial well-being and resilience in the face of income variability. Take charge of your financial journey with, and turn the challenges of variable income into opportunities for growth and stability.

Last modified: September 1, 2025